GMO Trading is a Cypriot CFD and Forex broker, headquartered in Cypriot Nicosia, regulated by CySEC. Since 2015 GMO Trading offers experience with more than 160 underlyings. The trading software used is the MetaTrader 4 . The company has a clear focus on newcomers to its additional services and educational materials.

The facts about GMO Trading at a glance

- Seat and license in Cyprus

- Market-making business model

- Around 160 underlyings for CFD and forex trading

- MT4 as a trading platform

- Mobile usable

- Maximum lever 1: 500

- Some educational materials for beginners

- Majors already tradable from 0.7 pips

- Demo account 14 days free of charge

- No additional funding

- Different account models

Trading in GMO Trading: These are the terms

GMO Trading does not charge any fixed fees for activity. So there are no custody charges or deployment fees. It looks different, however, when traders are inactive. Then they have to expect very high inactivity fees, which are even charged retroactively. In the first two months, a total of 160 euros, if the trader has performed no trade for at least 60 days, so 80 euros per month. The fees can rise to 500 euros a month and are not proportionate, even if only deposited credit can be used.

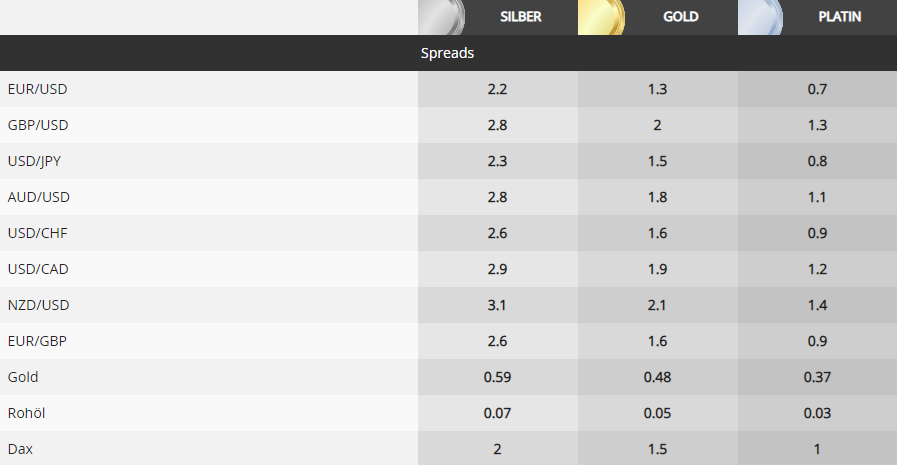

The broker raises further fees due to the market maker business model over spreads. So customers do not have to pay commissions. The premium on the usual market spreads seems to be low. At least the spreads the broker gives as the lowest possible spreads convince:

- EUR / USD: 0.7 pips

- EUR/GBP: 0.9 pips

- EUR/JPY: 1.1 pips

- DAX: 1 point

- SP 500: 0.8 points

The fees for trading are therefore just in the forex broker comparison fair. But users can not always count on the cheapest spreads. Actual values depend on market volatility and liquidity, risk and other factors.

Somewhat regrettable is that the broker does not give outsiders any details about the financing costs. These are high compared to other brokers, so the GMO trading fee model is not optimal for traders who want to hold positions more often overnight.

Professional Trader with advantages?

The broker offers all forex traders with appropriate activity and sufficient capital the opportunity to use a professional trader account that has some key differences.

So users can use a much higher lever. This increases to up to 500: 1 depending on the asset class and underlying, while the normal account ends at 30: 1. Accordingly, the required margin is significantly reduced before a closeout. Users can also participate in competitions and compete with other traders.

However, there is a big disadvantage. For example, traders are considered professional and experienced and therefore have no claim to be compensated in case of insolvency of the broker by the Investor Compensation Funds (ICF). This can be a major disadvantage in an emergency.

Those who want to qualify for the Professional Trader Account must meet two of the following three criteria:

- At least 10 trades in the quarter equivalent to at least € 3,000 for equities / cryptocurrencies or € 12,500 for forex or commodity trading . The trades do not have to be done at GMO Trading, but may have been opened at another broker.

- Traders must have worked actively in the financial industry for at least a year, with a focus on CFD trading.

- The financial portfolio including cash deposits and other financial instruments must be worth at least half a million euros.

Traders have to meet very high requirements in order to use this account. The advantages, on the other hand, are not necessarily convincing. The only real benefit is being able to use a higher leverage.

Account opening and benefits for new customers

The account opening at GMO Trading is straightforward and completed in a few steps.

- Users click on „Open Account“ at the top right of the website.

- It opens a registration form, in which customers enter the required data. They also have to accept the legal conditions.

- A second form opens with further personal data such as date of birth, address and details of the desired account.

- The customer must provide information on his occupation, knowledge and experience with the trader.

- After that, he can deposit money.

- In order to later be able to pay off money, he must also make a verification of his data. For this purpose, he submits copies of a valid ID card and a utility bill, on which his address is written.

Basically, the services of GMO Trading can initially be used without verification. It makes sense, however, if the customer submits the required documents as soon as possible.

Praiseworthy: At the opening of the account, customers can decide for themselves whether or not they want to allow them to contact GMO Trading by phone.

If you do not want to open a real money account right away, you may be able to clear your doubts with the demo account. It can be used free of charge for 14 days and allows you to put the trading platform and trading conditions through their paces. This way, anyone interested in GMO Trading CFD can gain experience without taking any risks. Advantages for new customers offer the broker not.

MetaTrader4 as a trading platform

Like Admirals and also the most of the Forex and CFD brokers, GMO Trading relies on MetaTrader 4 as a trading platform. With that the broker certainly makes a good choice, so that the GMO Trading Forex experience of most users can be positive. The MetaTrader 4 is considered the most popular retail trading platform and is therefore well-known to most traders with some experience.

The MT4 can be used in different versions of GMO Trading. You can choose from the WebTrader, a download variant and the app for Android and iOS.

The trading platform is characterized by its reliability and speed and also convinces with the chart analysis and possibilities to customize the trading platform. Traders can create their own indicators and perform exactly the desired analyzes with numerous tools. If you want to go back to the tried and tested, you can use dozens of indicators. The chart analysis can be carried out at a very high level and offers significantly more possibilities than many competing products.

One of the reasons why MT4 is particularly common in the CFD Broker comparison is certainly the fact that MSQL5 gives users the ability to develop their own add-ons or indicators. As a result, MetaTrader 4 plays an important role in automated trading. Thanks to easy-to-understand language, your own strategies can be easily implemented, ensuring that thousands of different Expert Advisor already exist, which in many cases are offered free of charge.

GMO trading without bonus and additional programs

After our experience with GMO Trading, the broker does not have too many promotions available to prospects or particularly loyal customers. Although many prospects consider such benefits to be a great strength, and often select a specific broker only on the basis of new customer bonuses, we recommend that you do not overstate such offers. Deposit bonuses, for example, are now frowned upon. The reason for this is that because of the coupled revenue conditions, they have been particularly prone to pay outs and have also led many traders to invest more money than planned in a shorter amount of time. This does not correspond to investor protection.

In addition, welcome bonus users must always expect to pay back their bonus over expensive spreads or other fees. As a rule, these are not the cheaper brokers offering such actions.

Users can rely on the Professional account if they have sufficient activity and trade volume. This gives you access to additional learning materials and competitions and allows you to leverage more. However, they lose their claims from the Investor Compensation Funds with the proxy statement. For many customers, the change is not worthwhile, even if they meet the requirements.

For customers outside Germany, the special promotions offered in cooperation with BVB could be interesting. Overall, however, the broker could invest more in customer retention and work more with other vendors. This allows traders to use trading signals, breaking news, or VPS servers.

Customer service at GMO Trading

According to GMO Trading, customer satisfaction is the top priority. Regarding the accessibility, there is hardly any room for criticism. Users can reach support around the clock on weekdays.

The broker is also very proud of its multi-language support. Overall, he supports seven languages. However, users can not assume that they can reach German native speakers at any time. It makes sense for a trader to speak English.

After our GMO trading experience the broker offers sufficient contact possibilities. Customers and prospects can contact the broker

- Live chat

- contact form

- phone

- Various e-mail addresses

to reach. The broker also specified an address. Whether this support takes place, is not very clear.

One drawback is certainly that it is hardly possible to obtain sufficient information from the website and to receive clear answers. There is no FAQ section, as provided by many other providers.

Anyone who advertises multilingualism must, of course, withstand a quality check of the translation. Unfortunately it becomes clear that the broker relies on an electronic transfer into German. Partly menu items or even sentences become completely incomprehensible. It would have made sense to invest a little more money here and to have the translation at least corrected.

Deposits and withdrawals: Beware of fees

Deposits and withdrawals are possible with GMO Trading in different ways. As a payment service provider, the company is leading eMerchant Pay, Paysafe, Decta, Wirecard and Safecharge, among others. For German customers, however, the CFD broker only advertises that this with

- VISA

- MasterCard

- maestro

- VPay

can deposit.

Customers can only withdraw money if they have at least 300 percent free margin. This is necessary in the opinion of the broker, in order to prevent a Margenausgleich. Customers must deposit at least 250 euros. This applies to the first deposit as well as to all other deposits.

When making payments, customers have to pay attention to one special feature: Anyone who does not make more than one transaction with the paid-in capital must pay a payment fee of 50 euros. Payments of deposits below 100 € are usually associated with a payout fee, which is also calculated individually, so that the trader in advance can not calculate correctly with the costs. So here are the conditions of GMO certainly not optimal. Customers also need to be aware that full data verification, including credit card or bank account numbers, is required prior to the first deposit. In addition, customers must use the account for which payments have been made for withdrawals.

Withdrawal requirements are handled very quickly by GMO Trading when the customer has verified their data. Processing takes place on the same day or at the latest on the next working day. In addition to the verification is a prerequisite that the free margin of the customer exceeds the payout sum.

GMO trading without a major role in public

GMO Trading is not known to the public. The broker is relatively unknown, so there are hardly any reviews on the Internet. The big test magazines and specialist magazines also do not deal with GMO Trading. Accordingly, it rarely happens that a customer reports GMO Trading CFD experiences. So far GMO Trading plays no role in the media. As a broker from Cyprus, the company has a hard time being taken seriously by the specialist press in Germany anyway. If you want to be respected in the German industry, you usually have to sit in Germany or Great Britain and be regulated by the local supervisory authorities.

GMO Trading wants to significantly increase its reputation in the next few years. That the broker is financially well-positioned for this does not seem to be a question. The company is one of the sponsors of Borussia Dortmund. The contract was only closed in June 2018. It is planned in future that customers of GMO can use special services, such as VIP tickets and merchandise of BVB. Web rights are exclusive to Europe and the Middle East, with Germany exempt. So that means that German BVB fans can not benefit from this. Outside of Germany, the broker has not noticed as well, to carry out the announced special promotions on a large scale.

Is GMO Trading reputable?

Basically, this is a question that can be answered badly from a distance. In the past, there were always providers in which, despite actually good regulation turned out to be fraudulent brokers. In general, a license in the EU shows a certain willingness to treat customers seriously and fairly. A broker who becomes active in the German market, however, has to accept the question of why he does not measure himself with the very large providers and, for example, has chosen the FCA as regulator.

A sign of seriousness is the transparency that GMO Trading has in some areas. Thus, the broker informs quite well about additional security measures and the storage of customer funds. In addition, the broker works in accordance with the policies issued by CySEC and has recently offered customers only a small amount of leverage and no bonuses, as well as explaining risks.

On the other hand, there are some features that make one doubt the trustworthiness of the forex broker. Thus, the broker does not openly disclose his (rather high) financing costs and charges unusually high inactivity fees, which can even be incurred retroactively. In addition, the deposit is not always free, without the fees are clearly stated. Such gaps in the terms and conditions promise in some cases nothing good.

Ultimately, traders will only be able to determine if a broker is reputable, fair and trustworthy if they have GMO trading experience themselves.

Conclusion: how good are the GMO Trading Forex experiences?

GMO Trading is a relatively unknown broker from Cyprus. He is regulated there by the Cypriot Financial Supervisory Authority and is a member of the ICF, the local deposit insurance. The company hopes to gain more prominence from the sponsorship of BVB, which, however, only applies outside Germany.

The terms of GMO Trading are mixed. As a market maker, the broker waives custodian fees or commissions and charges them as spreads. These start very cheap and are certainly a reason for many traders to sign up for GMO. However, the financing costs are significantly higher. An important disadvantage is the inactivity fees, which are far too high right from the beginning and can rise to up to 500 euros per month.

For action, the MetaTrader 4 is used, which convinces as usual by its versatility and reliability. If you want to test the trading platform, you can do this for 14 days free of charge. Deposit and withdrawal conditions are mostly fair, but customers should pay extra fees.

In addition to the account for retail customers, the broker offers a Professional Trader account. Ultimately, however, this only provides access to higher leverage, while the entitlement to compensation by the ICF expires.

The most important facts at a glance:

| 💰 Fees from: | Spreads start at 0,7 Pips |

| 🚨 Regulation: | CySEC |

| 💵 Minimum Deposit: | 0 € |

| 📋 Demo: | Yes |

| 📱 App: | Yes |

| 📊 Trading Offer: | Forex, CFD |

Questions & Answers to GMO Trading

Where's the broker's headquarter?

GMO Trading has its headquarter in Cyprus.

Is GMO Trading a regulated broker?

GMO Trading is regulated by CySEC.

Can I test trading on GMO Trading in advance?

Yes, GMO Tradingprovides a free demo account.

What commercial products does GMO Trading offer?

At GMO Trading you can trade for examle a round 160 underlyings for CFD and forex.